All Categories

Featured

Consider Using the penny formula: cent stands for Financial obligation, Earnings, Home Mortgage, and Education. Overall your financial obligations, home mortgage, and college expenses, plus your wage for the number of years your family requires security (e.g., up until the children run out the home), which's your protection demand. Some monetary professionals determine the quantity you require utilizing the Human Life Value approach, which is your life time revenue prospective what you're earning now, and what you anticipate to earn in the future.

One method to do that is to seek business with strong Financial stamina scores. renewable term life insurance policy can be renewed. 8A company that finances its own plans: Some firms can market plans from one more insurer, and this can include an extra layer if you desire to change your plan or later on when your family requires a payout

Mississippi Term Life Insurance

Some business provide this on a year-to-year basis and while you can anticipate your rates to increase significantly, it might deserve it for your survivors. Another method to compare insurance provider is by taking a look at on the internet customer reviews. While these aren't most likely to tell you a lot regarding a company's economic security, it can inform you just how easy they are to function with, and whether claims servicing is a trouble.

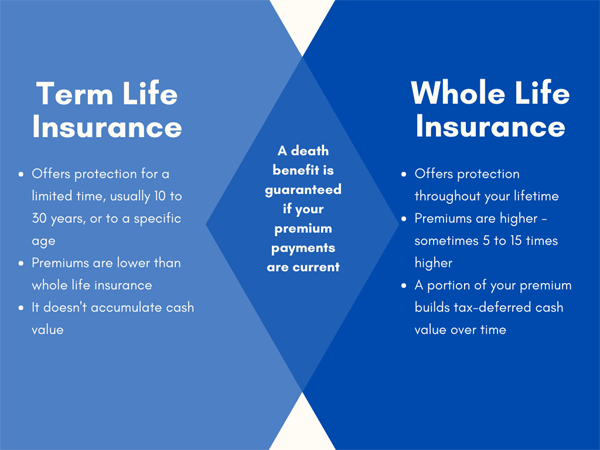

When you're more youthful, term life insurance can be a basic means to secure your enjoyed ones. As life changes your economic top priorities can too, so you might want to have whole life insurance for its life time protection and additional benefits that you can utilize while you're living.

Approval is ensured no matter of your health. The premiums will not increase as soon as they're established, however they will go up with age, so it's an excellent concept to secure them in early. Learn more about exactly how a term conversion works.

1Term life insurance supplies momentary protection for a crucial duration of time and is normally less expensive than long-term life insurance policy. is direct term life insurance good. 2Term conversion guidelines and restrictions, such as timing, might use; for instance, there may be a ten-year conversion advantage for some items and a five-year conversion opportunity for others

3Rider Insured's Paid-Up Insurance policy Acquisition Choice in New York. There is a price to exercise this cyclist. Not all getting involved plan owners are eligible for rewards.

Latest Posts

Decreasing Term Life Insurance Example

Price Of Funeral Insurance

Guaranteed Funeral Plan